Need a Copy of Your Tax Return? Here’s How to File Form 4506

Dec 09, 2024 By Susan Kelly

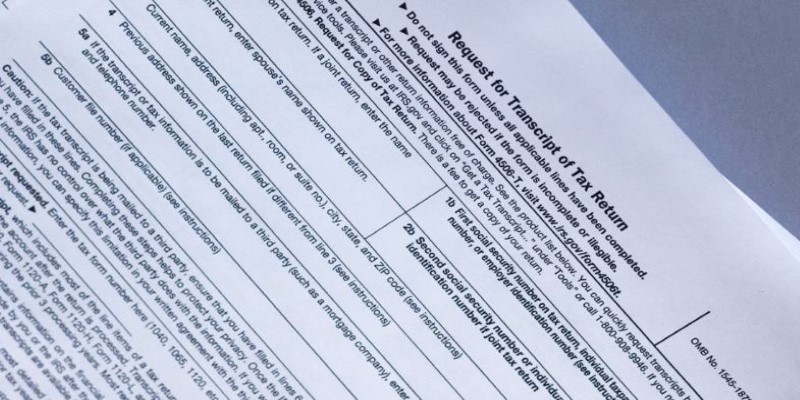

Filing taxes can be overwhelming, especially when you need copies of past returns for things like loans, financial aid, or audits. If thats the case, Form 4506, Request for Copy of Tax Return, provides a straightforward solution. This form lets you request official copies of your tax returns directly from the IRS, which is essential for verifying your financial information.

Understanding how to fill and submit a form 4506 will be much easier for you, whether you fill one for yourself or another person. This article walks you through the steps explaining the purpose of the form, filing steps, costs, and processing times.

What Is Form 4506?

Form 4506 is a request for a copy of your previously submitted tax return. The IRS issues the form to the individual, business, or entity seeking copies of their tax returns. While the federal government provides your tax transcript free of charge and in summary style, Form 4506 provides the full copy of the return with attachments and schedules.

The form may be submitted to request copies of tax returns from any of the previous six years. This can be really helpful for a variety of reasons, including perhaps proving income in a loan application or possibly being in the middle of a tax audit. The copy may also serve as a backup if the original return is lost.

Its important to know that requesting a tax return copy via Form 4506 involves a fee, and the process can take several weeks to complete. In this guide, we will look into how you can navigate the process smoothly and get your required tax documents without unnecessary delays.

Who Should Use Form 4506?

Form 4506 is mainly for individuals or businesses that need an official, full copy of their tax returns. If you just need a transcript of your return, Form 4506-T (Request for Transcript of Tax Return) might be the better choice as its free and quicker to process. However, if you need a complete copy of your return for legal purposes, financial verification, or other serious reasons, Form 4506 is your go-to.

This form is useful for:

- Individuals applying for loans, mortgages, or financial aid

- Businesses needing to verify past tax filings for lending purposes

- Taxpayers who need copies of tax returns for legal or auditing reasons

- People who lost their tax return documents and need a certified copy

The key distinction here is that Form 4506 provides you with a complete, verbatim copy of your tax return, whereas Form 4506-T only offers a summary or transcript.

Steps to Complete and File Form 4506

Filing Form 4506 involves a few simple yet important steps to ensure that your request is processed without any issues. Here's a breakdown of the filing process:

Gather Your Information

Before you begin filling out Form 4506, make sure you have all the necessary details on hand. This includes:

- Your name, address, and taxpayer identification number (such as your Social Security Number or Employer Identification Number)

- The type of tax return you are requesting (e.g., Form 1040, Form 1120)

- The year of the tax return for which you are making the request

- Your signature and date on the form, as well as the name of anyone authorized to request the document on your behalf

Complete the Form

To complete Form 4506, provide personal information (name, address), specify the type of return (e.g., 1040, 1120), list the years for which you need a copy, and state the reason for your request. On the second page, include payment details for the processing fee, which is typically $50 per return, though this can vary.

Sign and Date the Form

The form must be signed by the taxpayer or an authorized representative. To avoid processing delays, make sure the signature matches the name on the return and that it's dated properly.

Submit Your Request

Once the form is completed and signed, it needs to be mailed to the appropriate IRS address. Be sure to send it to the address indicated on the form. There are different addresses depending on where you live, so check the instructions carefully to ensure the form is sent to the right location.

The IRS does not accept Form 4506 by fax or email, so be sure to mail it using a trackable delivery method to ensure you have proof of submission.

Processing Time and Costs

One of the main considerations when filing Form 4506 is the associated costs and the time it will take to process your request. As mentioned earlier, the IRS charges a fee of $50 per copy of each tax return requested. If youre requesting several years of returns, these fees can add up quickly.

Processing times can vary, but it usually takes between 75 to 90 days to receive your official copy of the return. Its important to plan and allow plenty of time for the IRS to process your request. In some cases, the processing time can be longer if there are any issues with your request.

To track the status of your request, you can contact the IRS directly. However, due to high volumes of requests, be prepared for potential delays.

Conclusion

Form 4506 is a valuable tool for obtaining official copies of past tax returns for financial, legal, or personal purposes. While it involves a fee and can take several months to process, it ensures you receive a complete, verbatim copy of your return. Taking the time to accurately complete the form, considering processing times, and understanding the fees will help you efficiently get the documents you need. In most cases, Form 4506 is the most reliable way to obtain copies of your tax return.

Aldrich Acheson Dec 04, 2024

Synchrony to expand payments

Triston Martin Dec 09, 2024

Tax Relief Made Simple: A Beginner’s Guide to Section 1341 Credit

Vicky Louisa Dec 09, 2024

How to Get a 6-Month Extension for Filing Your Tax Return with Form 4868

Darnell Malan Dec 09, 2024

Capital Gains and Losses: A Breakdown of Schedule D for Tax Filings

Aldrich Acheson Dec 06, 2024

Balancing Automation and Manual Trading with Forex

Triston Martin Dec 18, 2023