Exchange Rates: What They Are and How They Work

Dec 06, 2024 By Pamela Andrew

Have you ever wondered why your money's value changes when you step off that airplane on foreign soil? Why is economic news always bombarding you with currency ups and downs? Understanding exchange rates is crucial to mastering the world of global finance.

What are Exchange Rates?

Exchange rates are the foundation upon which international finance rests since they are pivotal in global trade and investment. An exchange rate can be defined as the value of a nation's currency against that of another. This is somewhat simple, but it tells much about various countries' diversified economies.

The Basics of Currency Exchange

When you travel abroad, you directly deal with the so-called foreign exchange rate: the prices that prescribe how much of one currency you get in return against another. For example, assuming an exchange rate between the U.S. dollar and the euro of 1:0.85, you would get 0.85 euros for every dollar exchanged.

Factors Influencing Exchange Rates

There are several factors affecting exchange rates and making them dynamic and constantly changing:

- Economic Indicators include inflation rates, interest rates, and GDP growth.

- Political Stability: The government's policies and geopolitical events come under this category. Market Speculation:

- Trader sentiment and demand for currency pair supply also affect the value of exchange rates.

Why Exchange Rates Matter

Understanding the importance of exchange rates will help you make informed financial decisions as a traveler, investor, or entrepreneur.

Impact on International Trade

This directly influences the import and export costs since the currency purchase price will depend on the determination of the exchange rate. A strong currency makes exports expensive for foreign buyers, thus lowering the demand for the products. A weak currency would result in higher export earnings as such products become cheaper internationally. This factor commonly affects both multinationals and small local exporters.

Influence on Investment Decisions

To investors, exchange rates can constitute a substantial factor in returns from foreign investments. Currency fluctuations may inflate or deflate the value of overseas assets, and thus, one must be very careful about exchange rate risk when diversifying his portfolio internationally.

Effects on Travel and Tourism

If you plan an overseas trip, exchange rates can directly impact how much you can buy in another country. A high value of your currency means your destination is a better deal. Money will go further in a country whose currency has an unfavorable rate relative to yours. On the other hand, if that rate isn't favorable, you might need to rethink your travel budget or look elsewhere.

How Exchange Rates are Determined

Exchange rates depend on a combination of factors, including economic, political, and market elements. Anyone who deals with international finance or trade should be informed about the various determinants influencing exchange rates.

Supply and Demand Dynamics

There are two critical determinants of currency value: demand and supply. Strong economic growth or attractive investment opportunities in a country raise demand for its currency and, hence, tend to appreciate it. On the other hand, oversupply or lack of demand for a currency causes its value to depreciate.

Economic Indicators

Key economic indicators influence exchange rates, including GDP growth rate, inflation, and interest rate. A country's high interest rate typically attracts foreign investors, raising demand for the local currency. As a result, the value of such a currency may rise.

Political Stability and Policies

A nation's political climate and governments have much to do with the strength of its currency. Stable governments and sound economic policies are generally viewed as maintaining a high regard for their currency. In contrast, unstable governments or those with unsound fiscal policies may watch as their currency declines.

Market Speculation

Speculation among currency traders and investors is another variable that impacts the exchange rate. Their collective actions, based on forecasts of various economies, news, and market sentiment, can cause the value of currencies to fluctuate in the short term.

Factors that Influence Exchange Rates

Exchange rates fluctuate day in and day out because of several factors. Understanding these components will empower you in the somewhat complex world of foreign exchange markets.

Economic Indicators

A country's economic health has much to say about the value of its currency. Indicators such as GDP growth, inflation rates, and employment levels significantly affect exchange rates. For instance, high economic growth usually brings about high currency growth since it attracts foreign investment and demands its local currency.

Interest Rates

Central banks' monetary policieswhat one might call their decisions on interest ratesalso exert a far-reaching influence on exchange rates. This is because a higher interest rate usually attracts foreigners through increased demand for the domestic currency and, hence, its valuation. On the other hand, interest rate cuts could depreciate the currency.

Political Stability

Political events and governmental policy can dramatically alter the value of a currency. Events such as elections, policy changes, and geopolitical conflict build uncertainty that will impact investor confidence and currencies. A stable political environment generally promotes a strong currency.

Trade Balance

A country's trade balance, or the difference between exports and imports, also impacts its exchange rates. While a trade surplus, or excess of exports over imports, tends to appreciate, a deficit could depreciate. This relationship illustrates the interdependence between international trade and foreign exchange markets.

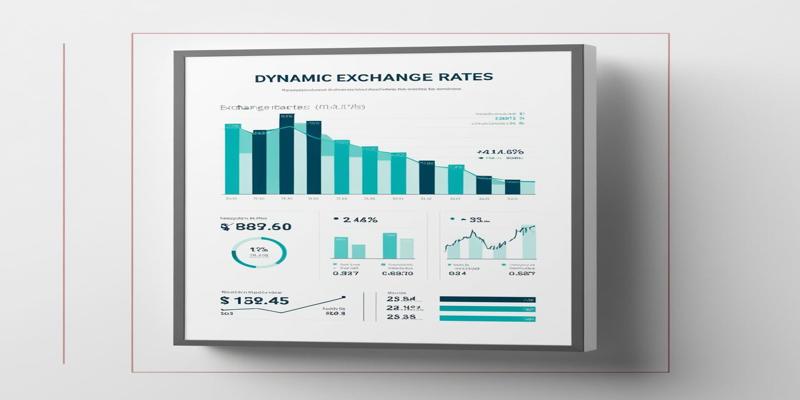

How to Track Exchange Rate Movements

Staying on top of changing exchange rates for international finance or travel is essential. Following are some of the easiest ways to do so

Use Financial Websites and Apps

Most financial websites and mobile phone applications provide up-to-the-minute information regarding exchange rates. Websites and apps such as Bloomberg, Reuters, and XE.com can be used to obtain current rates of several different currencies. Many of these sources also include historical data in chart format that enable you to analyze the trend over a period of time.

Set Up Alerts

Most currency trackers allow you to set up an alert here, usually customized to your choice. You can choose when the exchange rate of a selected currency reaches a particular value. This is an outstanding feature for investors or travelers waiting for a reasonable rate to transact.

Conclusion

Understanding the exchange rate means knowing the prevailing condition of world finance. As you have read, these rates reflect the relative value of currencies according to various economic factors. Knowing the changeability of these exchange rates will provide you with full awareness when making decisions concerning international investment, tourism, and business deals.

Verna Wesley Dec 04, 2024

Klarna CEO indicates US initial public offering

Vicky Louisa Dec 09, 2024

How to Get a 6-Month Extension for Filing Your Tax Return with Form 4868

Susan Kelly Nov 04, 2023

Relationships Between Real Estate Agents

Susan Kelly May 12, 2024

Travelers Life and Annuity Company Review and Analysis

Georgia Vincent Sep 27, 2024

FHA Mortgage Insurance Premium: What Homebuyers Need to Know

Pamela Andrew Sep 05, 2024