How an International Payment Provider Works

Dec 06, 2024 By Elva Flynn

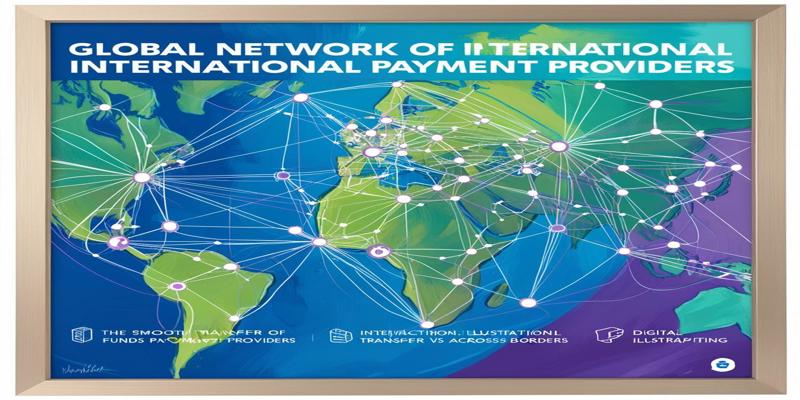

How do companies seamlessly conduct financial transactions across borders? Welcome to the international payment provider, the key to unlocking global commerce. As the globe becomes increasingly connected, specialized financial institutions in this field have become part and parcel of cross-border payments, currency exchange, and money transfers internationally.

What is an International Payment Provider?

International payment providers provide various financial services to facilitate cross-border transactions or enable businesses to receive customer payments worldwide. These providers are crucial in today's global economy, allowing companies to broaden their reach and access new markets.

Key Features and Benefits

The use of international payment providers offers quite several advantages to businesses:

- Multiple modes of payment: credit cards, bank transfers, and, at the latest, digital wallets.

- Currency conversion: They provide a gateway to currency conversion so that customers can make payments in their local currency while the money the business receives is in their country's currency.

- Compliance and Security: Merchants ensure international standard transaction compliance and tight security measures against fraudulent activities.

Challenges and Considerations

While international providers of payments offer several advantages, every business should be aware of the following potential challenges:

- Fees and Costs: Fees and costs are higher in cross-border deals compared to domestic ones and can also include charges for currency conversion and intermediaries

- Regulatory Complexity: Navigating various regulatory requirements across countries can be difficult and requires extra effort in compliance

- Payment Processing Time is longer in international transactions because processing involves more security checks and multiple financial institutions are involved in a transaction cycle.

How International Payment Providers Work

With the rise of globalization, the world has become more interconnected; however, cross-border transactions have become increasingly complicated. These tailored intermediaries facilitate seamless financial transactions across multiple countries and combat challenges brought forth by differences in currencies, regulations, and banking systems.

The Foundation of Global Transactions

International payment providers allow businesses and individuals to pay and get paid from others internationally. Most offer various services, such as currency exchange services, international wire transfers, and online payment processing. Strategic relationships with local banks and other financial institutions worldwide develop a robust network for accessing various cross-border transactions.

Critical Components of the Process

Various crucial steps are involved in the cross-border payment process. According to Papaya Global, it generally involves the following steps:

- Choosing a payment method (e.g., wire transfers, international ACH, e-wallets)

- Checking exchange rates

- Providing recipient details

- Verifying the payment

- Sending the funds

- Tracking the transaction

Overcoming Challenges

Any international payment provider must jump over boulders of hindrances to facilitate rapid and nimble settlements. Some of these are value destruction through a high transaction cost, poor speed, lack of reach, and lack of transparency. Most service providers use superior technologies to speed up the processes. For example, ISO 20022 will provide a common language for payment data and increase the quality and speed of cross-border transactions.

Benefits of Using an International Payment Provider

Expanding Global Reach

With an international payment partner, the potential reach can increase tenfold globally. By opening your enterprise to new markets and more sources of income, you can accept payments anywhere in the world. Such expansion allows you to tap into a diversified pool of customers, increasing sales opportunities and catalyzing business growth on the global platform.

Enhanced Customer Experience

International payment providers provide an impeccably smooth and localized payment process, essential for customer satisfaction. They also support multiple currencies and various payment methods according to local preferences, making it easier for foreign customers to conduct transactions. This improved user experience can result in higher conversion rates and ensure more customer loyalty.

Streamlined Operations

With the help of an international payment provider, it is easy for organizations to shy away from the complexities involved in the administration of cross-border payments. Providers typically provide automated transaction processing and integrated systems that can ease operations and reduce the administrative workload of an organization. This efficiency enables one to pay more attention to the core business activities while guaranteeing seamless and smooth processing of payments across borders.

Robust Security and Compliance

Most of the time, international payment gateways have advanced security and follow all regulatory requirements. This includes fraud protection, chargeback management, and adherence to international financial regulations. If you find a suitable partner, your risks regarding international transactions will be lowered, and consequently, you'll protect both your business and your customers' sensitive information.

Top International Payment Providers

International payment providers play a vital role in the current globalized economy, acting as competent partners for dependable cross-border transactions. Let's look at some of the major players in the market.

Industry Leaders

PayPal operates in 202 countries and supports 25 currencies, making it a leading player in the market. Its wide acceptance and ease of use make it popular for all sizes of businesses. Stripe is another leading player, supporting over 135 currencies in 46 countries. It offers customized checkout experiences and versatile APIs that offer seamless integrations.

Specialized Solutions

Stax will offer an expandable platform featuring no transaction fees and automatic volume discounts to companies that handle high-value transactions. Volume-based discounts make Helcim unique, making it an excellent option for these companies.

Emerging Players

Of late, BVNK and Nium have been the talk of the town in the B2B cross-border payment space. They add value with their multi-currency accounts and embeddable finance capabilities. These operators solve some of the most usual pains in cross-border payments, such as high costs, slow processing time, and limited support for multiple currencies.

Conclusion

First, international payment providers are an important intermediary linkage in today's globalized economy. It readily enables corporations and individuals to send and receive money across borders. When considering your financial needs, rest assured that choosing the right provider will mean all the difference regarding your bottom line and operational efficiency.

Vicky Louisa Sep 27, 2024

How to Secure a Larger Mortgage Preapproval: A Step-by-Step Guide

Triston Martin Feb 21, 2024

The ABCs of Value-Added Tax (VAT): Basics, Obligations, and Effects

Verna Wesley Dec 04, 2024

Klarna CEO indicates US initial public offering

Susan Kelly May 08, 2024

Navigating Tax Deadlines: A Comprehensive Guide for Individuals and Businesses

Triston Martin Dec 09, 2024

Tax Relief Made Simple: A Beginner’s Guide to Section 1341 Credit

Susan Kelly Dec 22, 2023