How to Use Keltner Channels for Day Trading

Jan 05, 2024 By Triston Martin

Keltner Day traders can utilize channels, a well-liked technical indicator, to assess the current trend and generate trading recommendations. The channels plot upper, lower, and middle lines using volatility and average prices. These three lines sway with the price, giving the chart a channel-like appearance.

Application Of Keltner Channels To A Stock Chart

Chester Keltner invented Keltner Channels in the 1960s, but Linda Bradford Raschke improved the indicator in the 1980s. The indicator that is currently in use is this latter model.

The actual average range (ATR) and the exponential moving average (EMA) are two additional indicators that are combined to form Keltner Channels (ATR).

The average price over a predetermined number of periods is the moving average. The exponential variation gives more recent prices more weight, while less recent prices are given less weight.

Here is how to compute Keltner Channels:

EMA + Upper Band (ATR x multiplier)

EMA = Middle Band

Lower Band: EMA minus (ATR x multiplier)

Any value can be chosen for the EMA period. An EMA of 15 to 40 is typical for day trading.

You can change the multiplier according to the asset you're trading. Although two is typical, you might find that 1.7 or 2.3, for instance, gives you better information for the particular market you trade. The channel will be more significant the higher the multiplier and narrower the lower the multiplier.

Adjusting the Indicator Properly

Keltner Channels are helpful because they can increase the visibility of a trend. A rising trend in an asset's price should cause it to approach the upper band, occasionally crossing over it frequently. The price will frequently remain above the middle band or merely budge below it while remaining above the bottom band.

An asset moving lower should frequently reach or approach the lower band and occasionally cross over it. The price will frequently remain below the middle band and should not rise above the upper band.

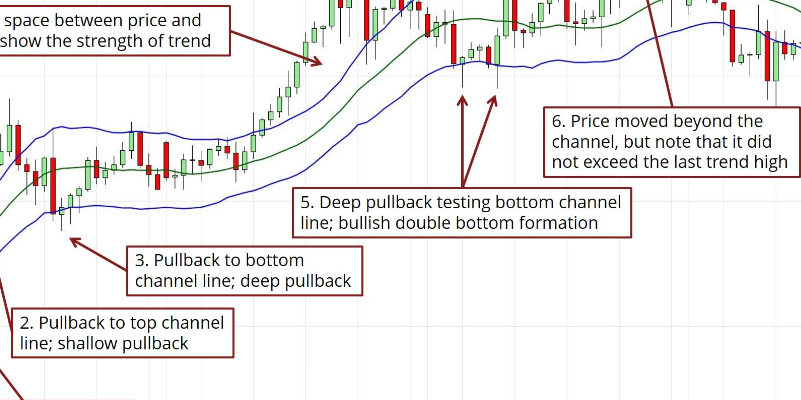

Trend-Pullback Technique

trends in the Keltner channel and a pullback plan

The general approach is to buy during an uptrend when the price pulls back to the middle line once the indication has been appropriately set up. Set a target price close to the upper band, with a stop loss placed approximately midway between the middle and lower bands.

The Breakout Technique

The trend-pullback method could miss significant moves, which the Keltner Channel breakout technique aims to catch. Use the breakout technique primarily in the hours before a significant market open. The most explosive movement happens then, which is advantageous for this tactic.

In the first 30 minutes after the market opens, the basic strategy is to purchase if the price breaks above the upper band or sell short if the price slips below the lower band.

Combining The Breakout And Trend-Pullback Strategies

The Keltner Channel Day Trading Breakout method is intended primarily for assets that typically move sharply and consistently around a significant market opening. The trend-pullback approach is more beneficial throughout the day, and the only prerequisite is the occurrence of a trend that complies with the rules.

Warning Notes

You might need to significantly modify your Keltner Channel settings if you trade various assets. It's possible that the settings you use for one asset won't work or be the optimum settings for another asset.

Practice trading on the signals of the Keltner Channels indicator in a demo account before using it to make real-money trades. Decide on which transactions to accept and which to reject as you practice. It would be best if you didn't think about trading with real money until you have had several practice sessions and consistently succeeded.

What is the purpose of the Keltner Channel?

Trading professionals may quickly see an investment's volatility and average price using Keltner Channels. Traders can use this to spot stocks that have moved substantially from their usual trading range. This can offer a chance to trade the security when it returns to the trend zone. A trend change or "breakout" may occur if the securities maintain price action outside the Keltner Channel; this offers a new set of trading chances.

What Keltner Channel settings work best for scalping?

The Keltner Channel trading techniques for swing trading are also effective for day trading. The movements will only change in that they will be quicker and more petite. You should shorten the measurement time and the EMA period to capture these smaller, quicker movements.

Triston Martin Dec 09, 2024

Tax Relief Made Simple: A Beginner’s Guide to Section 1341 Credit

Susan Kelly Sep 27, 2024

Broker Price Opinions Explained: What You Need to Know

Verna Wesley Dec 06, 2024

Factors Influencing Currency Exchange Rate

Triston Martin Feb 07, 2024

A Quick Overview: Roth IRA Early Withdrawal Penalties

Elva Flynn Dec 06, 2024

How an International Payment Provider Works

Susan Kelly May 08, 2024