A Quick Guide to the Roth IRA Required Minimum Distributions (RMD)

Jan 28, 2024 By Susan Kelly

Introduction

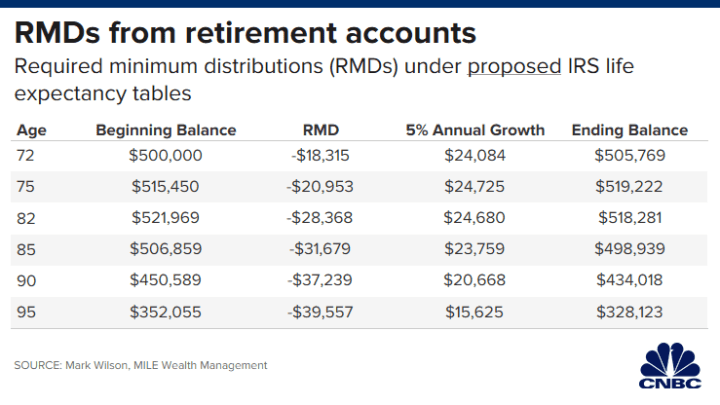

Your required minimum distribution (RMD) is arrived at by dividing the value of your traditional IRA by a life expectancy calculation provided by the Internal Revenue Service (IRS). You can take the whole RMD amount from either a single IRA or a mix of IRAs, but you are required to compute your required minimum distribution (RMD) for each IRA you own. RMDs derived from qualified retirement plans or inherited IRAs, on the other hand, have to be computed separately and can only be withdrawn from the accounts from which they were initially inherited. Regarding Roth IRAs, RMDs are not required to be taken out.

Work Waiver for RMDs

There are several circumstances where it is possible to lower RMDs or perhaps wholly prevent them. You can delay drawing RMDs from your current employer's 401(k) until you retire if you are still working after you reach the age of 72 and do not own 5% or more of the company in which you are employed.

Despite this, you will still be required to withdraw RMDs from your previous 401(k) accounts. However, there is a way around that obstacle. You have the option of doing so if the 401(k) plan offered by your present company permits the transfer of funds into the program. If you do that, you can put off the requirement to withdraw an RMD from your 401(k) until you are ready to retire. (You would still be required to withdraw required minimum distributions from any traditional IRAs you own.)

RMDs Apply to Traditional IRAs

People with specific retirement plans, such as 401(k) plans, regular IRAs, SIMPLE IRAs, and SEP IRAs, are required to begin taking money out of their accounts after they hit the age and half of the plan's name in parentheses. Those who turn seventy and a half after July 2019 will have until 72 to pull money out of their retirement accounts. These Required Minimum Distributions (RMDs) specify the bare minimum sum that must be taken out of your account on an annual basis. 2

The RMDs are considered part of the retiree's taxable income and are consequently liable for income taxes because of this inclusion. RMDs allow the Internal Revenue Service to collect taxes on money exempt from taxation up until this point. This is possible because tax-deductible accounts, such as traditional IRAs, enable you to deduct the money you put into them and postpone paying taxes until you retire. Because of this, any amount of a withdrawal that was taxed in the past ought to be recognised as tax-free and won't be counted as taxable income. One example would be money rolled over from a Roth account into a 401(k) account.

RMD Rules for Roth vs Traditional IRAs

After reaching a particular age, you must withdraw a minimum amount of money from your retirement account annually. This withdrawal is known as a required minimum distribution or RMD. This amount is determined by the Internal Revenue Service (IRS), and if you withdraw money from a traditional IRA, the amount you take out will be subject to income tax at the same rate you are now paying. A missed RMD is subject to a penalty of fifty percent from the Internal Revenue Service. 2

You are required to begin withdrawing RMDs from a conventional IRA no later than April 1 of the year after the year in which you turn 72 (the previous age threshold of 70.5 still applies if you reach that age by January 1, 2020). You have no choice but to accept them, even if you do not require the funds for day-to-day costs. Your required minimum distribution (RMD) is calculated using the ending balance of your account from the previous year (as of December 31) and your age at the time of the calculation. Many other retirement funds, such as 401(k) plans, adhere to the same guidelines. You will nearly always be required to pay income taxes on those withdrawals.

Taxes

RMDs are treated as ordinary income for tax purposes by the IRS. This signifies that withdrawals will be counted toward your total taxable income for the year and will be taxed at the individual federal income tax rate that is relevant to you. Furthermore, withdrawals may also be subject to taxes levied by state and local governments. Your required minimum distribution (RMD) must be calculated based on the overall balance of your IRA (such as in a traditional IRA). Still, your taxable income may be lowered proportionately for the after-tax contributions if you have a traditional IRA and made contributions to it after taxes. Bear in mind that this rise in your income could potentially place you at a higher tax rate, which could affect the amount of money you pay in taxes toward your Social Security and Medicare benefits.

Conclusion

At 72, you must begin withdrawing money from your traditional individual retirement account (IRA) according to the required minimum distributions (RMDs). In contrast to regular IRAs, Roth IRA owners are not subject to required minimum distributions (RMDs) during their lifetime. The beneficiaries of a Roth IRA are required to take RMDs to avoid incurring penalties, except spouses, who are exempt from this rule.

Susan Kelly Dec 07, 2023

Creating Adoption Budget

Susan Kelly Jan 20, 2024

Financial Planning For Graduate School

Susan Kelly Nov 18, 2023

All You Need to Know About College Scholarships and Grants

Triston Martin Jan 05, 2024

How to Use Keltner Channels for Day Trading

Triston Martin Dec 28, 2023

2/28 Adjustable-Rate Mortgage (ARM) and Its Working Explained

Susan Kelly Mar 24, 2024